Change Research, led by a project team of Gen Z and Millennial pollsters, conducted a poll of 1,033 voters between the ages of 18 to 34, from August 25-September 1, 2023. Our survey found that young voters, regardless of educational attainment, are experiencing significant economic stress ranging from covering an unexpected $100 expense, to foundational middle class goals, like buying a house or having children. Some key findings are included below.

Young voters have a very negative perception of how things are going in the US.

Just 4% think things are going on the right track nationally. More, but still a substantial minority of voters think things are on the right track in their state (22%), city or town (27%) or in their neighborhood (28%). Currently, just 23% of voters think the American Dream is achievable, while half believe it was once achievable, but no longer is and 27% think the American Dream has never been achievable.

There is no doubt that voters’ economic realities are a major driver of this pessimism.

- 8% think the national economy is “excellent” or “good”

- 17% think their state economy is “excellent” or “good”

- 22% think their local economy is “excellent” or “good”

- 23% describe their personal finances as “excellent” or “good.” 35% say it’s “fair” and 40% say it’s “poor”

The cost of living and inflation are the top two highest-ranked concerns, and this is leading to constricted consumer spending.

While a plurality of voters report spending “more than I should” on housing (52%) and restaurants (44%), large portions say they’re spending “not enough” on vacations and travel (49%), concerts and live events (40%), gifts (35%), and clothing (32%).

There is a widespread lack of confidence in young voters’ ability to meet major economic milestones:

A majority of young people are not confident that they’ll be able to retire, own a home, have an emergency fund that could sustain them for 3 months, start a business, or have as many kids as they want.

Economic concerns go beyond these large financial decisions and extends to fairly basic middle class lifestyle items.

Significant numbers of young voters are not confident the’ll be able to stop living paycheck to paycheck, go on a vacation once a year, buy whatever they want at the grocery store, afford nice clothes, or have a reliable car.

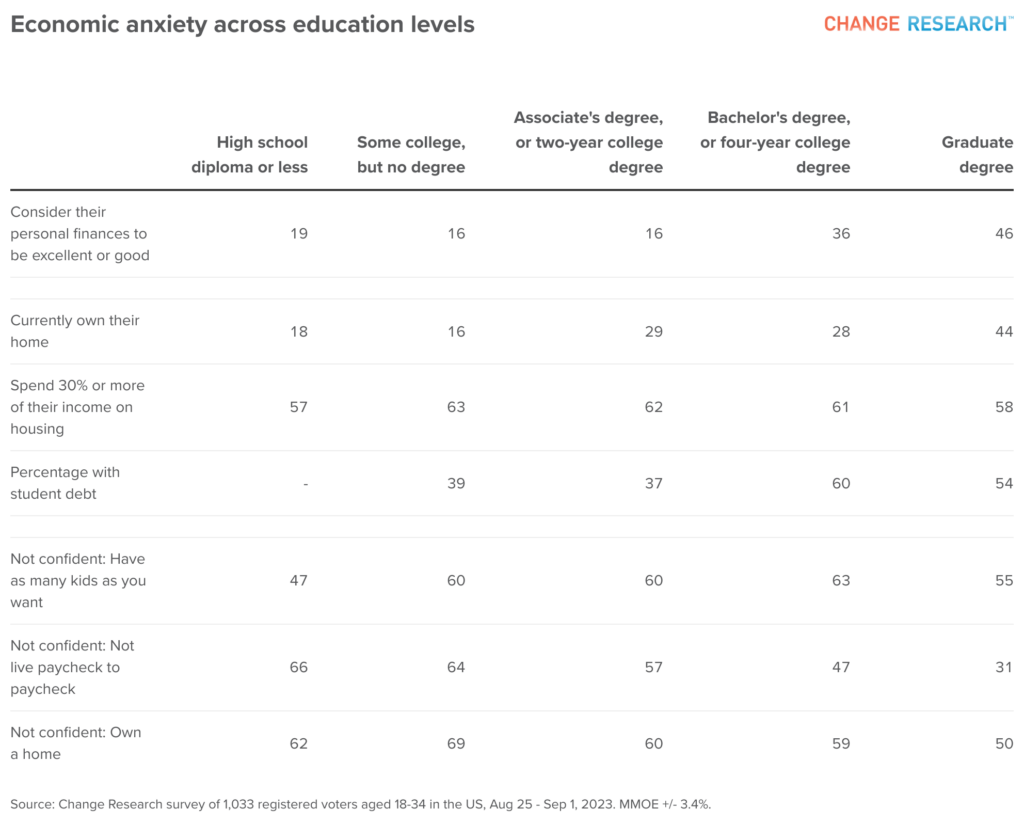

These economic challenges are not simply the plight of the least-advantaged young voters. Rather, they are widely held regardless of educational attainment.

While most acute among voters without a college degree, a minority of voters in every single education category consider their personal finances to be “excellent” or “good”. The vast majority of voters in every education category are spending more than the recommended 30% of their income in housing. And even among the most highly educated, those with a graduate degree, 31% don’t feel like they’ll be able to break away from living paycheck to paycheck, half are not confident they’ll be able to own a home and 55% don’t think they’ll be able to have as many children as they want.

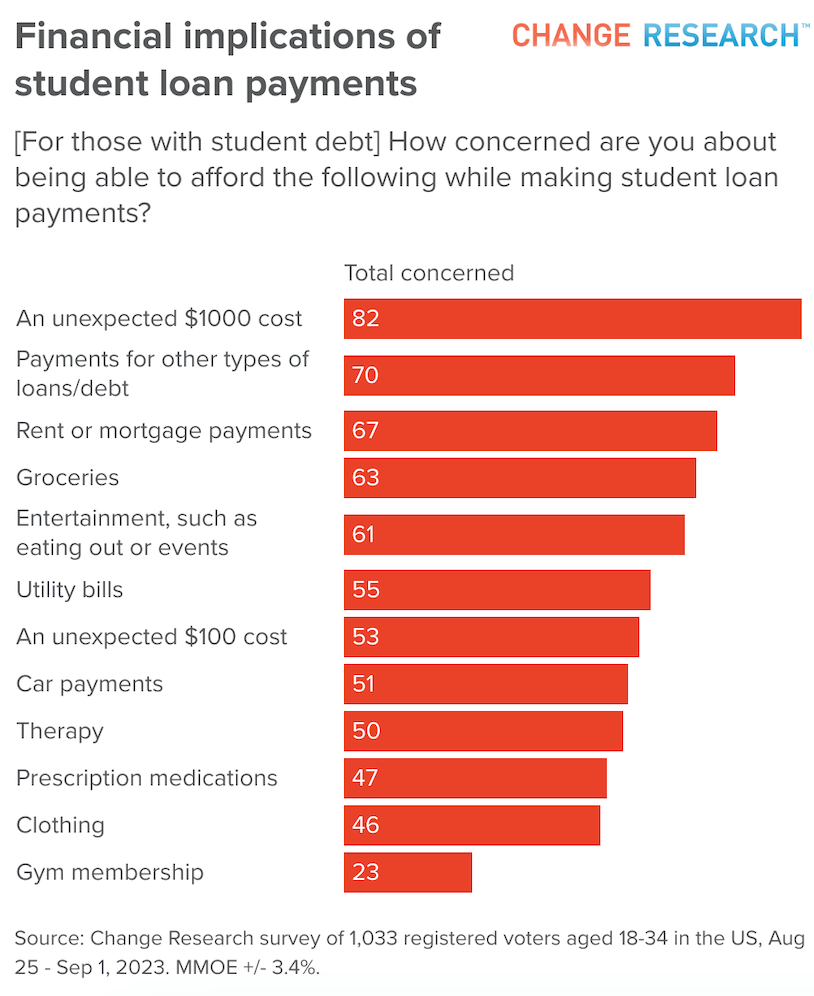

The Supreme Court’s decision to block President Biden’s student debt relief plan is a major economic stressor for the many young Amerians with student debt, a decision that is opposed by 65% of young voters.

Those with student debt are most concerned about being able to afford an unexpected $1000 cost, payments to other types of loans/debt, rent or mortgage payments and groceries.