Change Research poll: October 22nd-25th, 2020; likely voters in the battleground states of Arizona, Colorado, Florida, Georgia, Iowa, Kansas, Maine, Michigan, Minnesota, Missouri, Montana, Nevada, New Hampshire, North Carolina, Ohio, Oregon, Pennsylvania, South Carolina, Texas, Virginia, and Wisconsin

As the race for President winds to a conclusion, Joe Biden leads 51% to 45% in the 21 most potentially competitive states nationwide. Voters also trust Biden more on taxes than Donald Trump (47% trust Biden more, 44% trust Trump more). They are engaged with the stories about his taxes, and desire fundamental changes to the tax system next year and new laws requiring presidential candidates to release their taxes so we are not kept in the dark about a potentially compromised chief executive.

The following summarizes results of a recent survey of 1689 voters living in a potentially competitive state in this year’s presidential election. The survey was conducted from October 22nd through 25th.

-

A large majority of voters are following the stories the New York Times is running detailing President Trump’s tax returns and business and a majority believe they are true. Almost 9 in 10 (89%) say they are familiar and a third (33%) are extremely familiar. A majority (58%) believe these stories are true. Only 34% don’t believe the stories.

-

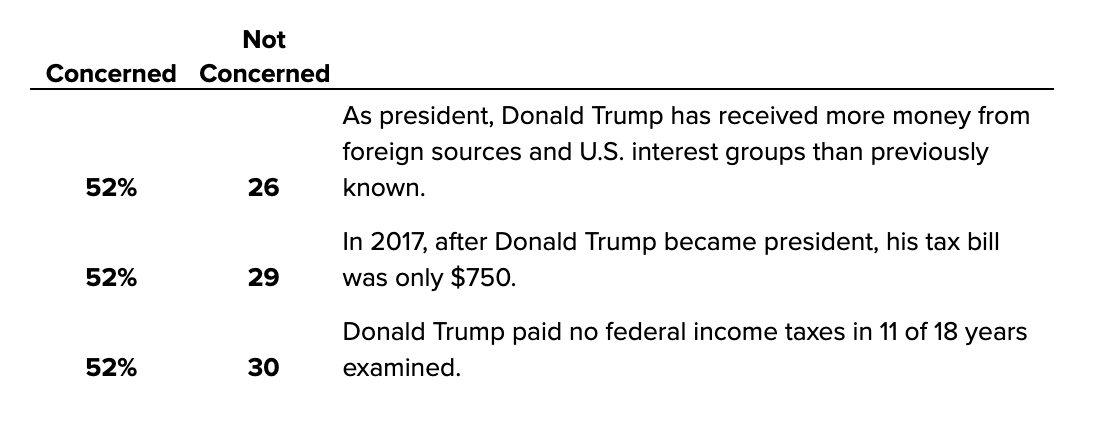

Majorities are most concerned with the following aspects of the stories with less than a third saying they don’t concern them.

-

Voters see the unfairness of the current system that allows Donald Trump to avoid paying his fair share, as unhealthy and embarrassing. 56% say that it is embarrassing that someone who says he or she is worth over a billion dollars but pays just $750 in federal income taxes. An even greater share (68%) think a system that allows some billionaires to pay only $750 in federal income taxes is sick.

-

A solid majority (61%) of voters believe that overhauling the current tax system and replacing it with a simpler system where the wealthy and corporations pay a higher share of their income than they currently do should be a high priority next year for the President and Congress. This includes 95% of Democrats and 62% of Independents. They support this because a similar majority (62%) believe the current tax system–that gives special favors and allows wealthy people to game the system and pay less than their fair share–is a bigger problem than people breaking the law,not paying taxes they owe and the government not prosecuting them.

-

Voters want reform. 63% support a law requiring the President to release their tax returns for each year they are President. 59% support a law requiring all candidates for President to submit copies of their last 10 years of tax returns for examination whether they are under audit or not. A majority (54%) support requiring the release of Donald Trump’s tax returns for the time he served as President once he is no longer in office.

-

58% believe that Donald Trump and his family are paying too little taxes. Even more voters believe that members of Congress (70%), those making over a million dollars a year (64%), corporations (64%), and those making over $400,000 a year pay too little. The need to overhaul the tax code extends past Trump.

Methodology

Polling was conducted online from October 22nd-25th, 2020. Using Dynamic Online Sampling to obtain a sample reflective of the 2020 electorate, Change Research polled 1689 likely voters in the battleground states of Arizona, Colorado, Florida, Georgia, Iowa, Kansas, Maine, Michigan, Minnesota, Missouri, Montana, Nevada, New Hampshire, North Carolina, Ohio, Oregon, Pennsylvania, South Carolina, Texas, Virginia, and Wisconsin. Post-stratification weights were made on state (each state is weighted based on their number of Electoral College votes), age, gender, race, education, and 2016 vote to reflect the distribution of voters within the battleground.