Recent Black Friday reports indicate that Black Friday shoppers spent more money this year even though they bought fewer items. New polling by Change Research, conducted as part of the internal Compass Poll that feeds into the Change Research Data Portal, reinforces this trend. Many Americans are feeling squeezed as the holiday season approaches, and the data shows that these pressures are widespread across age groups, genders, and political parties.

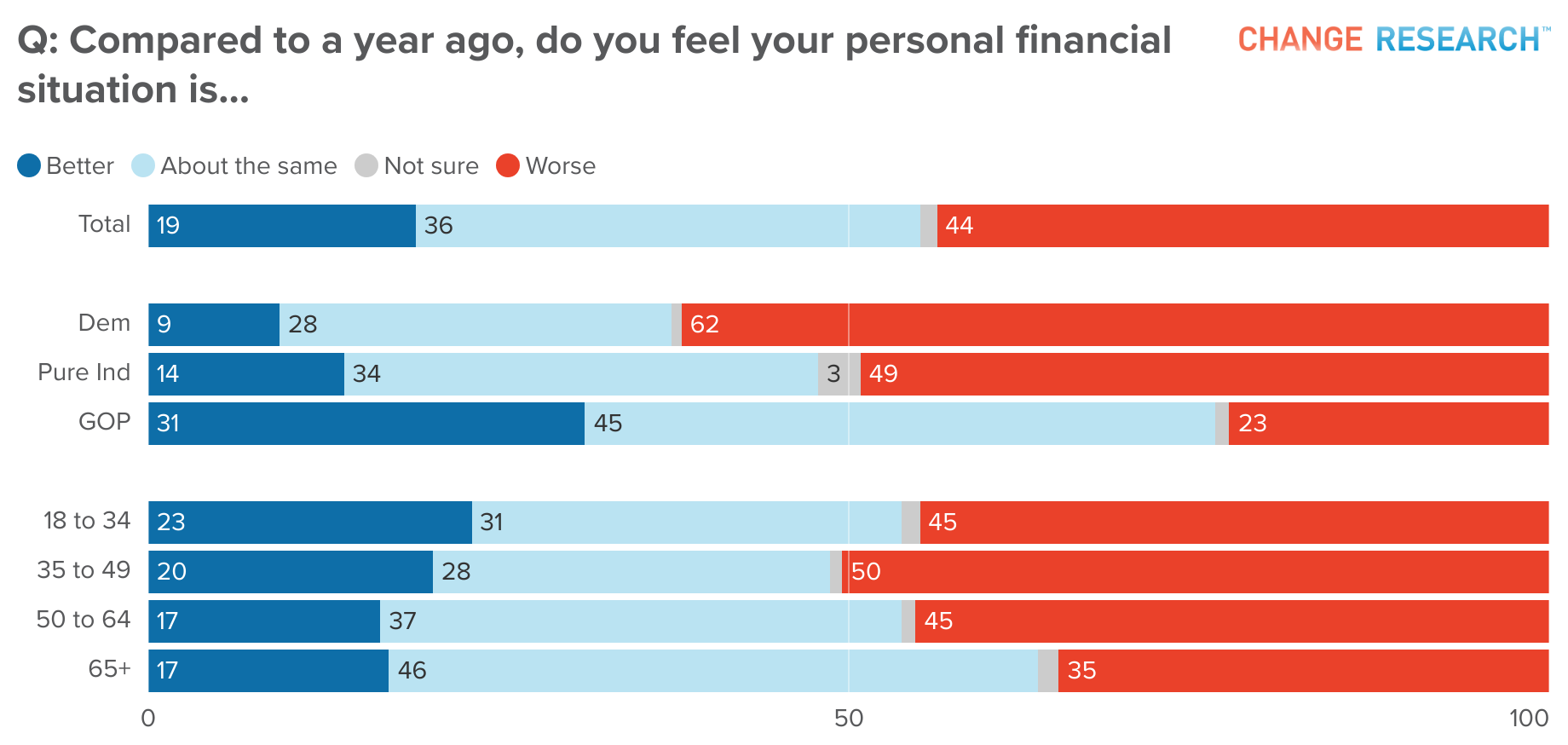

According to the national survey conducted by Change Research between November 19 and December 2, 2025, 44% of respondents say their personal finances are worse than a year ago. Thirty six percent say things are about the same and only 19% report improvement. The financial strain reported by Democrats is especially sharp, with 62% saying they are worse off, compared to only 23% of Republicans.

Everyday Costs Creating the Most Strain

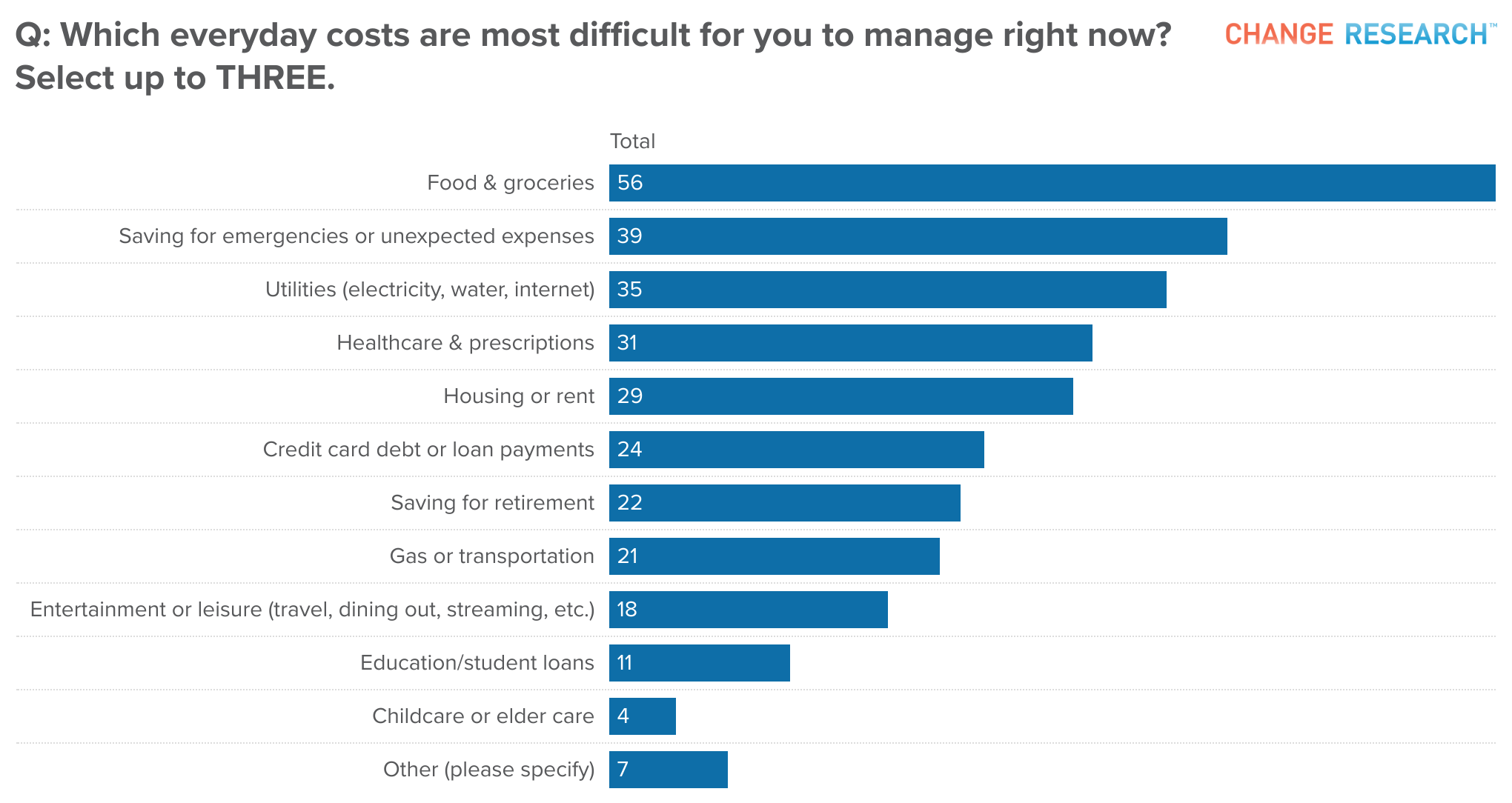

When people are asked which everyday expenses are hardest to manage, food and groceries rise to the top at 56%. Saving for emergencies or unexpected expenses follows at 39%, and utilities come in at 35%. Healthcare and prescriptions create difficulty for 31% of respondents. Concerns about housing or rent affect 29%.

The data reveals notable differences by age group in cost pressures. Younger adults ages 18 to 34 are especially likely to struggle with housing costs. Half of people in this age group list housing as a top concern. Only 12 percent of adults ages 65 and older report the same problem. Older Americans feel the most pressure from healthcare and prescription costs. That group reports this difficulty at a rate of 33%.

Women report higher difficulty across most cost categories. This is especially pronounced for food and groceries at 60% compared to 52% of men. Healthcare costs also hit women harder, with 34% reporting strain compared to 27% of men.

Long Term Worries Focus on Inflation and Healthcare

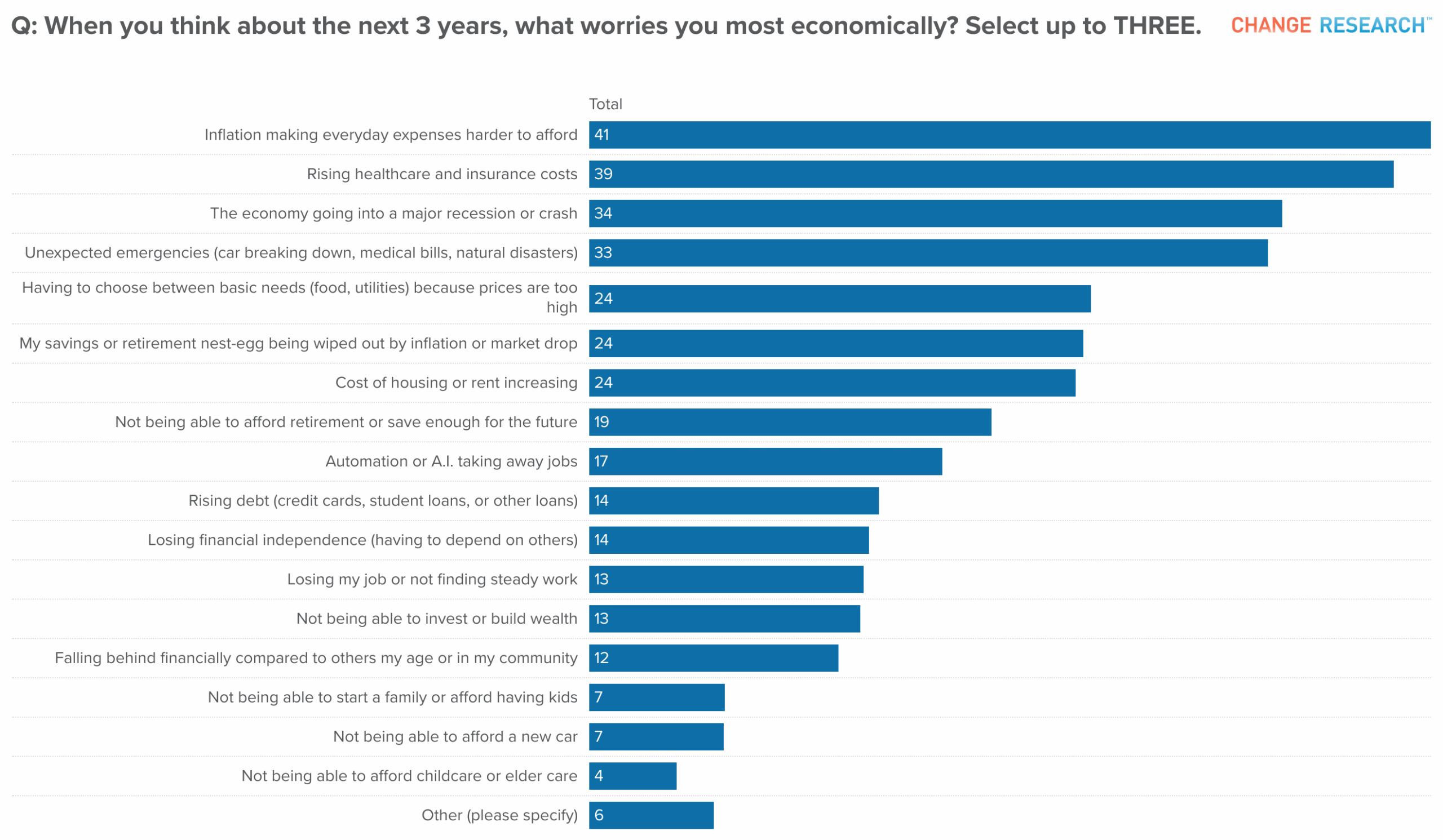

When asked to think about the next three years, Americans’ top reported economic worry is inflation making everyday expenses harder to afford, cited by 41% of respondents. Rising healthcare and insurance costs are close behind at 39%. Another 34% worry that the economy will enter a major recession or crash.

Concern about unexpected emergencies like car repairs, medical bills, or natural disasters affects 33% of respondents. Nearly a quarter, 24%, worry that prices will rise so much that they will have to choose between basic needs. Equal shares worry about their savings or retirement being wiped out by inflation or a market drop and about increasing housing or rent costs.

Adults ages 65 and older are the most worried about rising healthcare and insurance costs at 49%. Only 27% of adults ages 18 to 34 share that concern. Younger Americans show greater worry about rising housing costs at 37% and about job automation at 22%. Older respondents are more likely to worry about their retirement savings, with 33% of those 65 and older concerned about losing their nest egg.

Holiday Spending Takes a Hit

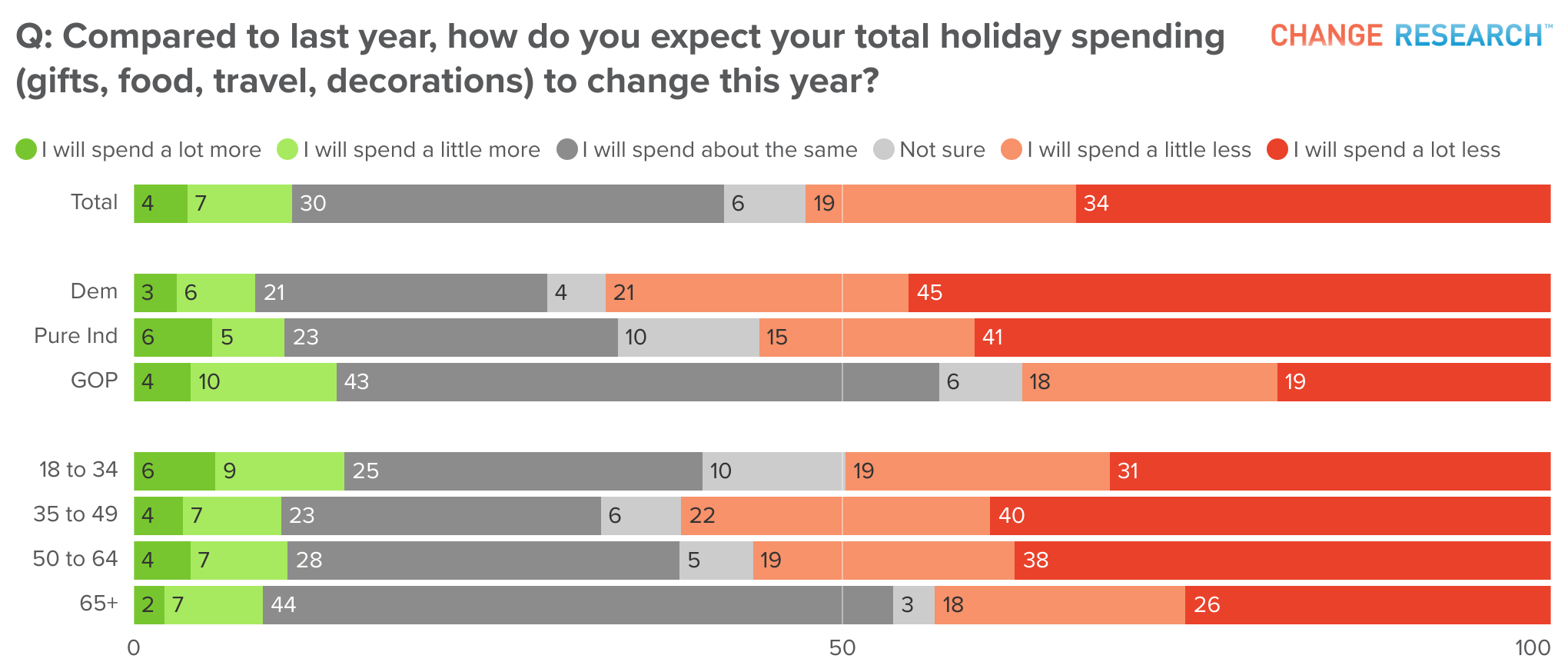

These financial pressures are influencing holiday spending plans. More than half of Americans, 53%, say they will spend less this holiday season compared to last year. This includes 34% who plan to spend a lot less and 19% who plan to spend a little less. Thirty percent expect to spend about the same and just 11% plan to spend more.

The spending pullback cuts across political groups but is stronger among Democrats. Forty five percent of Democrats say they will spend a lot less compared to 19% of Republicans. Women also report deeper reductions. Forty two percent say they will spend a lot less compared to 25% of men.

Among adults ages 35 to 49, 40% plan to spend a lot less. Only 26% of respondents 65 and older say the same.

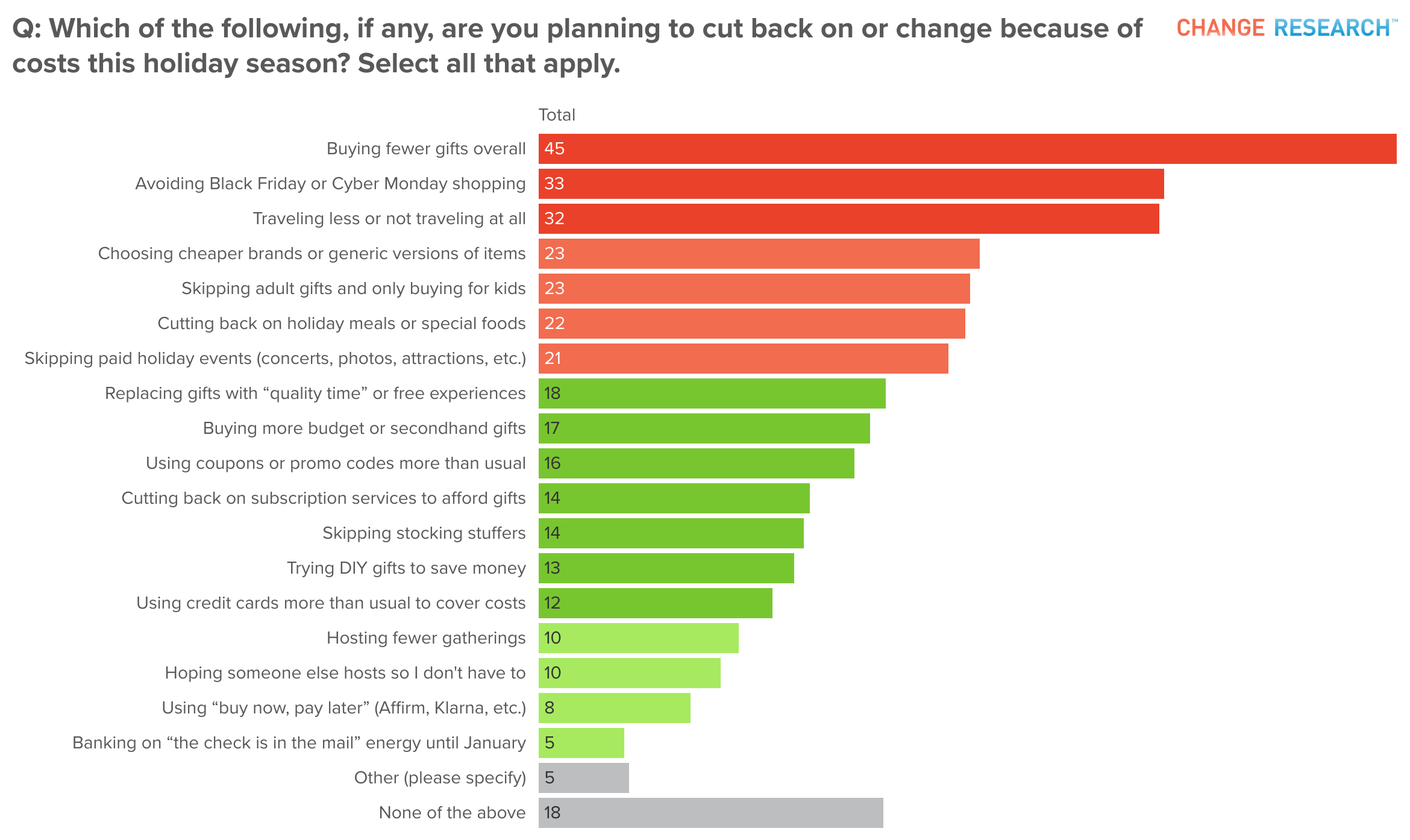

How Americans Are Cutting Back

People are adjusting their holiday budgets in several ways. The most common approach is buying fewer gifts overall, with 45% of respondents planning to cut back in this category. One third say they are avoiding Black Friday or Cyber Monday shopping. Another 32% say they are traveling less or not traveling at all.

Other strategies include choosing cheaper brands or generic items at 23%, skipping adult gifts and only buying for children at 23%, and cutting back on holiday meals or special foods at 22%. About one in five respondents are skipping paid holiday events like concerts or family photos (21%) or replacing gifts with quality time or free experiences (18%).

Democrats report higher rates of cutbacks across nearly all categories. For example, 55% plan to buy fewer gifts compared to 33% of Republicans. Twenty seven percent of Democrats plan to buy more budget or secondhand gifts compared to 13% of Republicans.

Younger adults ages 18 to 34 are more likely to use credit cards more than usual to cover holiday costs at 16% and to use buy now, pay later services at 11%. Older adults are more likely to avoid certain purchases instead of using those tools.

Taken together, the findings show an American public that is adjusting to financial pressure in a variety of ways. People are watching their budgets, reshaping their holiday plans, and preparing for costs that they expect will continue to rise. As the season moves forward, these patterns offer a clear view of how financial strain is shaping both routine spending and the traditions many families value.